Mastering Essentials of Downturn

Here is an overview of the basic Essentials while economy goes downturn that

TFAGroupwill

address for you:

Indicators:

Indicators showing the beginning of a crisis, which can be caused by

external and/or internal factors. Issues and solutions Set:

|

Possible symptoms of a crisis |

The underlying problem |

|

Decrease in revenue

Loss of customers or employee

Insufficient profitability

Negative cash flow

Not enough liquidity

|

Turnaround situation are often caused by external and/or internal

factors: Possible external factors (market view):

Possible internal factors (company view):

|

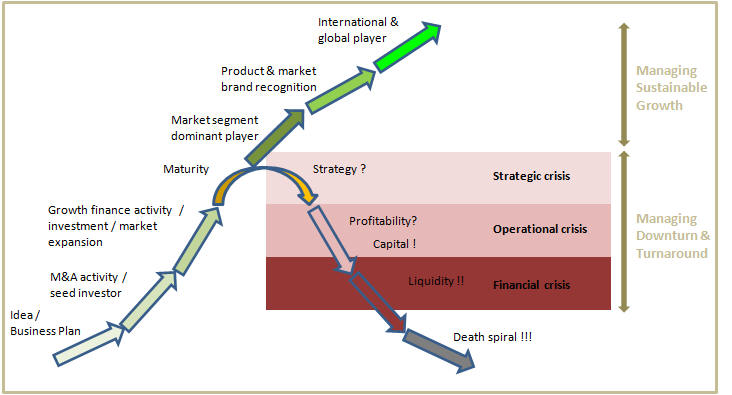

Level of crisis defines remaining range of actions

Fundamental paradigm

·

The earlier the crisis is recognized, the broader is the range of actions

available.

·

The sooner restructuring actions are taken, the higher is the probability of

success.

·

The longer actions are delayed, the more urgent and dramatic measures will

be.

·

In a financial crisis a lot of curtail management resources will be absorbed

by short term liquidity / equity stabilizing measures and stakeholders

management.

Root cause of crises

TFAGroup

expertise and experiences helps you as early as possible to identify the

level of crisis defines remaining range of actions. Qualitative symptoms are

difficult to detect but provide earlier warnings than quantitative figures.

Quantitative symptoms can be observed only with a delay but detection can be

automated. Financial and operational figures should be benchmarked against

the industry.

Turnaround management approach and the main challenges

TFAGroup

has a tailored turnaround service to specific challenges

of our clients. The turnaround essential 7 Steps are:

1.

Business review: as is analysis of company, development of restructuring

options

2.

Operational restructuring: identification of actions to regain / maintain

profitability

3.

Balance sheet restructuring: identification of actions to regain / maintain

healthy equity/dept situation

4.

Working capital management: optimization of creditors, debtors and inventory

to increase liquidity and reduce capital employment

5.

Contingency planning: development of fall-back options and definition of

trigger points

6.

Stakeholder management: stakeholder management concept to align diversity of

interests

7.

Evaluation of exit-scenarios (decreased-sale, wind-down, liquidation) for

companies and parts thereof